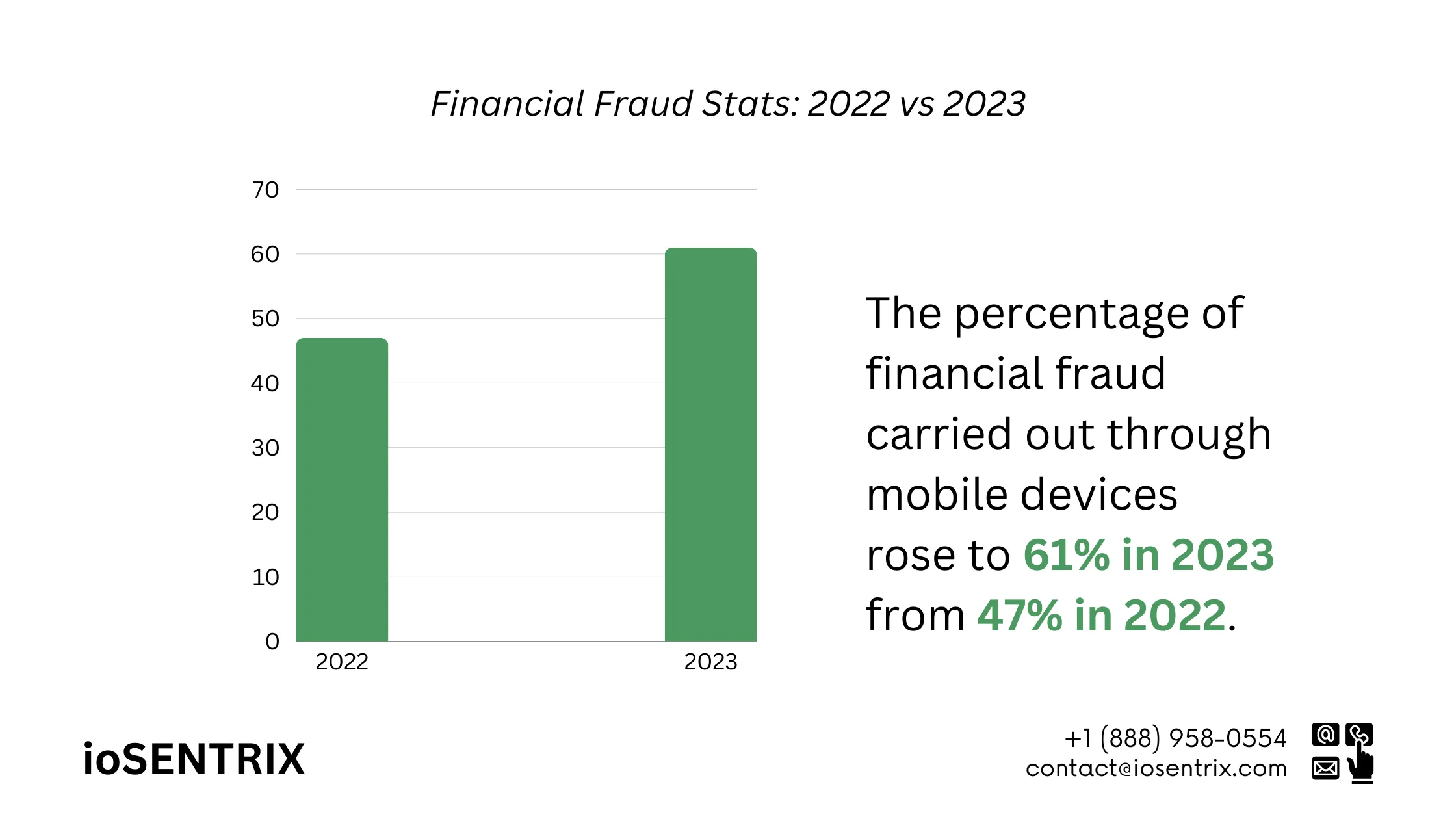

According to the American Bankers Association, half of American consumers prefer managing their bank accounts through a mobile device. The top reasons for choosing mobile banking include convenience, features like personalized financial advice, savings tools, big-purchase calculators, and virtual assistants, offering greater control over finances. While mobile banking offers many benefits to users and organizations, the rising popularity also attracts complex cyber attacks targeting these apps. Organizations report that the average cost of a mobile application security incident is just under $5 million (source: Vanson Bourne).

This blog offers insights on mobile banking app security, discussing emerging technologies, primary risks, and recommendations to enhance app security.

Cybersecurity experts affirm mobile banking’s safety but stress the need for user precautions. According to Paul Benda, the senior vice president for operational risk and cybersecurity at the American Bankers Association, “Obtaining the mobile app from a secure store is as safe as visiting a bank branch”.

Benda advises downloading mobile banking apps directly from your bank’s website to ensure authenticity and security. He further explains, “Banks utilize highly secure encryption technologies. We often liken mobile apps to carrying a bank branch in your pocket”. The Growing Need of Authentication in Mobile Banking Security

The convenience of mobile and online banking has simplified money management for users. They can easily open new accounts, transfer money, and settle credit card payments directly through their mobile banking apps or websites.

However, the absence of in-person contact highlights the importance of digital authentication methods to verify users’ identities during account setup and each time they log into their accounts. Authentication methods in mobile banking must be effective, reliable, and accurate.

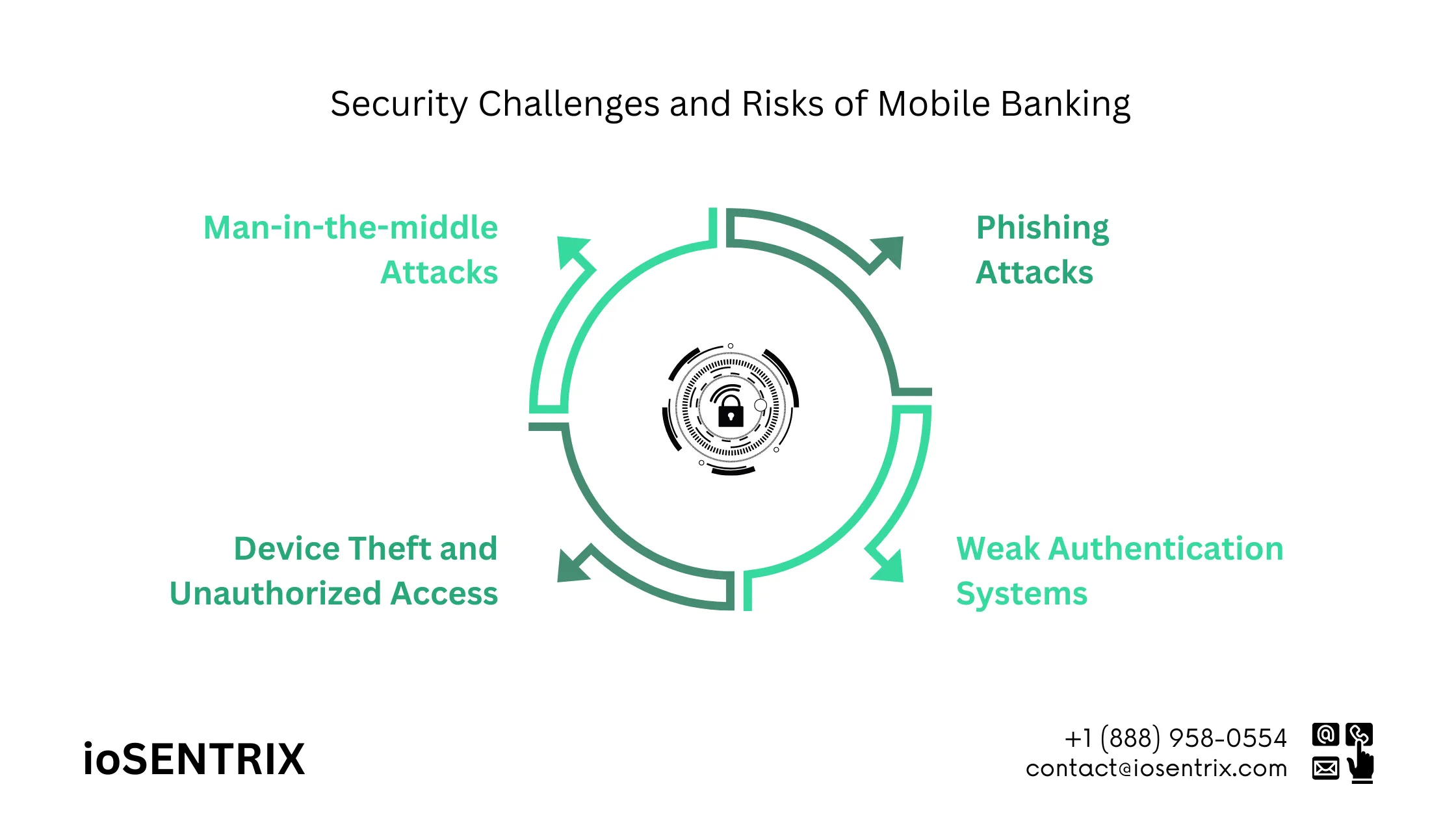

Mobile banking presents distinct challenges and risks that need to be addressed effectively. Understanding these risks, their mechanisms, and prevention strategies is crucial for protection.

Key security challenges and risks in mobile banking are:

Among the most prevalent forms of fraudulent activities are phishing attacks. These attacks deceive users into disclosing sensitive account information like usernames, passwords, or two-factor authentication codes. Phishing attacks commonly occur through email, SMS text messages, or counterfeit notifications and websites. In some cases, advanced attackers may develop bogus banking applications to harvest login details.

The data obtained from phishing attacks is used to infiltrate a user’s account or engage in synthetic identity fraud by creating new accounts using falsified and stolen credentials.

Cybercriminals exploit vulnerabilities in the standard authentication methods that mobile apps commonly rely on. Insufficient employment of multifactor authentication (MFA), usage of weak passwords, and the habit of reusing credentials across various platforms enable fraudsters to breach users’ mobile banking accounts.

Fraudsters have improved their techniques to exploit vulnerabilities even in advanced methods like biometric security.

Cell phones and other mobile devices are prone to being lost or stolen, posing a risk of unauthorized access to bank accounts and sensitive data by malicious individuals. Despite banks mandating passcodes, PINs, and biometric checks, hackers often manage to evade these security protocols.

Users must safeguard their devices against security risks, while banks should introduce an additional security barrier to prevent identity theft. Features like biometric authentication from an identity verification provider can block hackers from gaining entry into accounts, even if they manage to bypass the device’s security measures.

In a man-in-the-middle (MitM) attack, an unauthorized party intercepts the communication between a user and the banking server. For instance, the attacker may capture a user’s username and password on an unsecured network or public Wi-Fi, or acquire a one-time password transmitted over an insecure channel. These attacks occur without the user’s awareness.

Financial institutions must apply appropriate security measures to identify suspicious or fraudulent activities on a user’s account. Equally important is the provision of educational resources on preventing MitM attacks, such as recommending the use of VPNs or advising account holders to refrain from logging into their accounts on public Wi-Fi networks and hotspots.

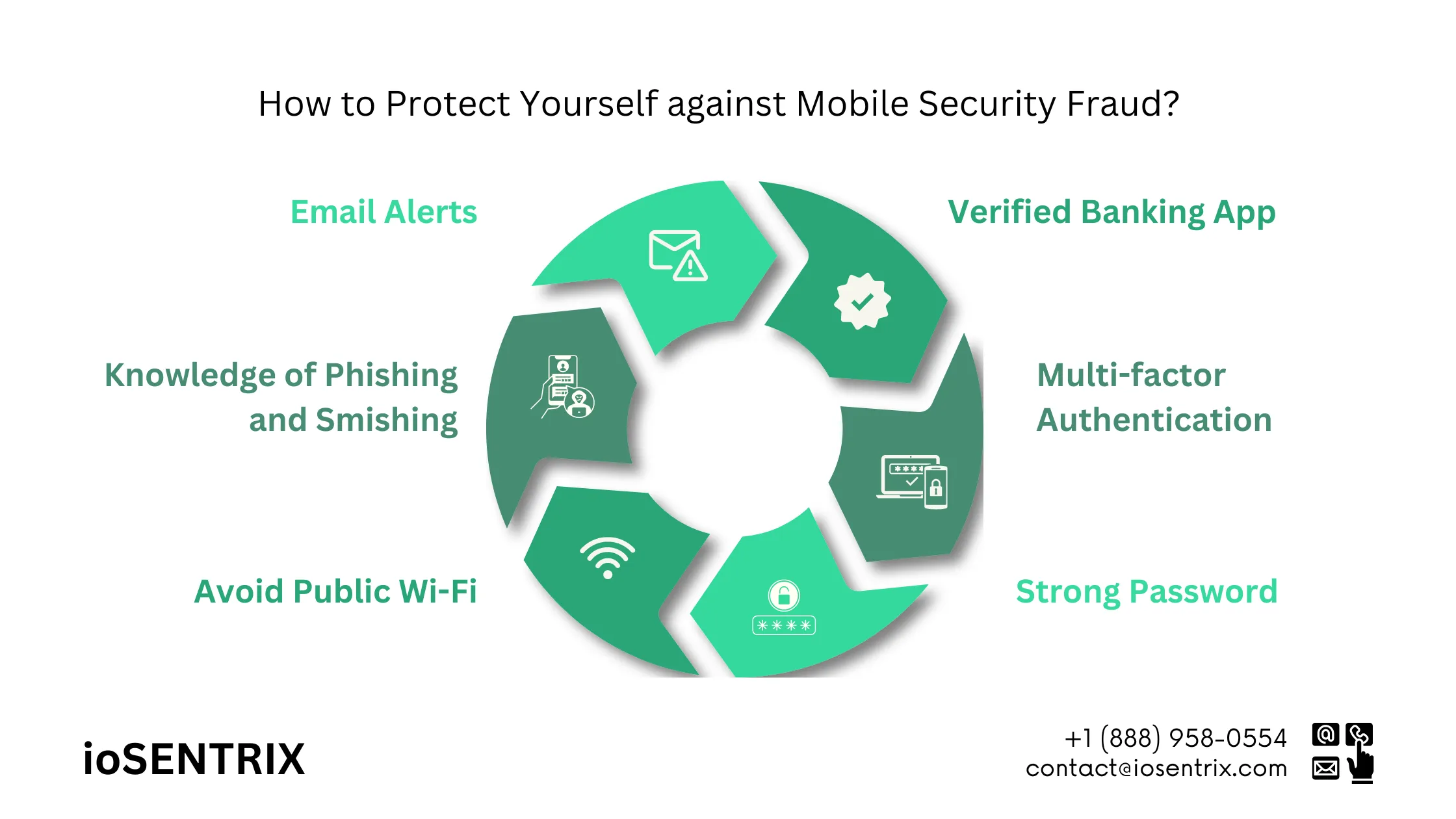

Get a trusted banking app directly from your bank’s website. Most banks provide links to the app stores on their websites to guide you in downloading the correct app. According to FS-ISAC’s Walsh, “Your bank should offer details about their mobile app, its features, and access requirements”, “Make sure to use a reputable app store, check the app’s owner/developer and look out for similar apps with the same name”.

It’s advisable to confirm with your bank, but avoid downloading apps from open forums.

Methods like biometrics in multi-factor authentication provide an additional level of security to stop hackers from getting into real users’ accounts. They also prevent scammers from making online banking accounts using stolen identities or login details obtained through phishing attacks or data breaches.

A strong method to safeguard yourself is by using a password that includes random uppercase and lowercase letters, numbers, and symbols. It’s best not to rely on your browser to store it; instead, use a trustworthy password manager.

“Respected password managers are designed to lower risks for users and are strongly protected against possible attackers”, Korinchak explains. “Many cybersecurity professionals suggest using password manager software”.

When you connect to a public Wi-Fi hotspot, you may receive a notification that the network is not secure, and others could potentially monitor your online activities. This is a significant reason to avoid conducting any financial transactions on a public network. It’s safer to use your cellular network or home Wi-Fi to enhance the protection of your personal information.

Become knowledgeable about phishing and smishing. Phishing emails can appear genuine, as they are from your bank or credit card company. However, identity thieves use them to deceive individuals into sharing personal information, and they might contain harmful software.

Smishing employs a similar strategy but operates through text messages.

“Users should have a good understanding of their banking app to recognize unusual requests or pop-ups that deviate slightly from the usual functions”, Walsh advises.

Receiving a quick alert from your bank regarding transactions on your account can assist you in identifying possible fraudulent actions. This allows you to effectively deal with the issue by contacting your bank.

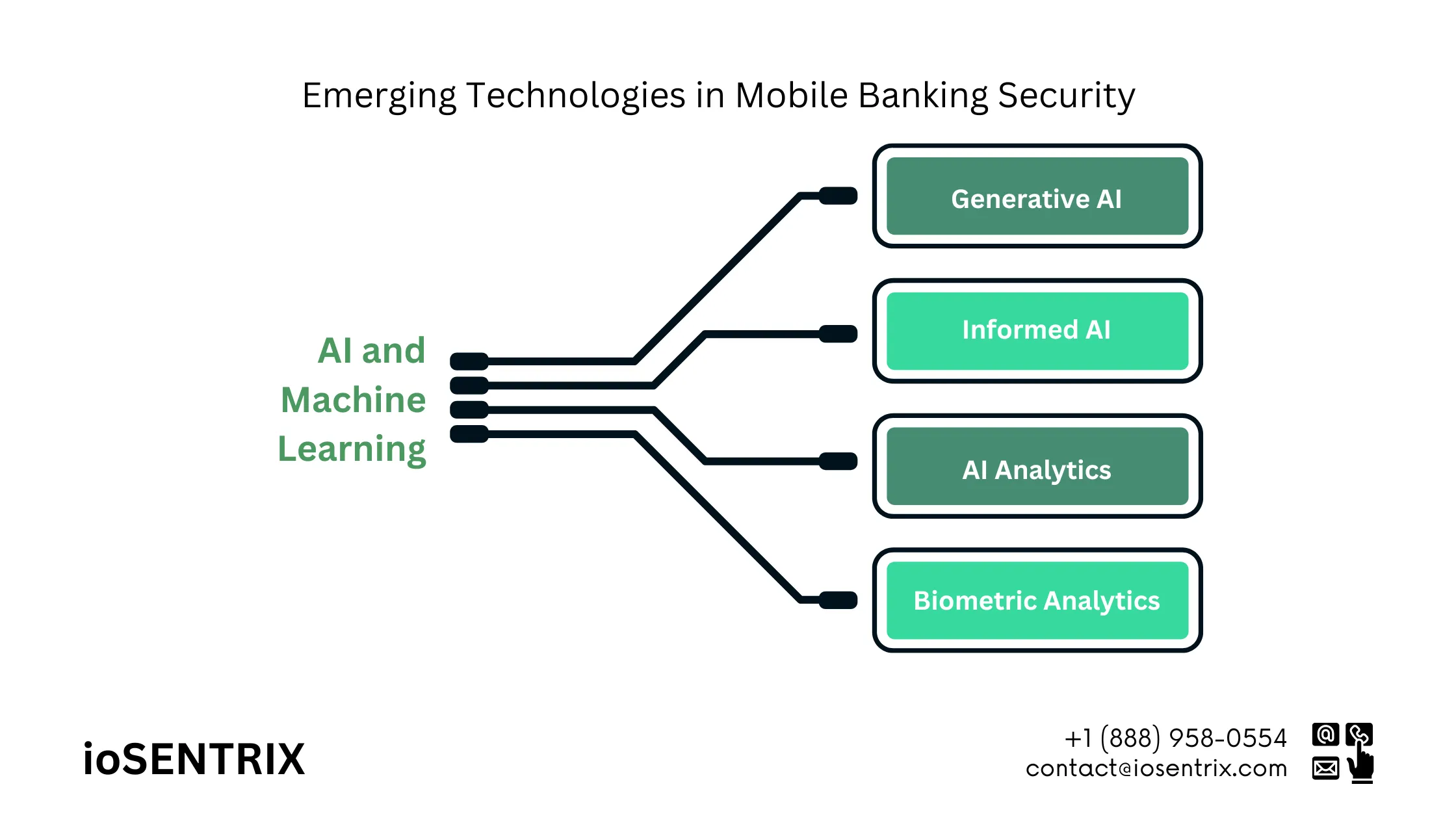

New technologies are improving security in mobile banking. Here are some key areas where improvements are being made.

AI and machine learning are increasing mobile banking security by enhanced threat detection, fraud prevention, and improved user authentication. Here are a few examples:

Generative AI can aid in fighting against fraud by generating synthetic datasets that mimic actual transactions and user behaviors. These datasets can be utilized to enhance training models through machine learning algorithms, hence, increasing the effectiveness of AI-based fraud detection methods.

Informed AI improves authentication procedures by using real-world production datasets to provide more accurate, informed, and unbiased AI verifications. This approach is quicker, more precise, and effectively keeps fraudsters at bay while maintaining user experience for legitimate account holders.

AI-powered predictive analytics assist in identifying fraud indicators during user onboarding or ID verification processes. Advanced behavioral analytics simplify the detection of complex connections that may suggest fraud rings or suspicious activities.

Biometric analytics compare selfies with photo IDs to verify if the individuals in both images are the same. This advanced technology aids in preventing identity theft and fraudsters’ attempts to hijack legitimate accounts.

Blockchain technology offers a decentralized and unchangeable record-keeping system for maintaining records and identities. Users can establish secure digital identities on the blockchain, granting them greater authority over sharing their personal information and deciding who can view it.

Blockchain technology, alongside machine learning algorithms, enable the examination of transaction trends to identify potentially concerning activities or irregularities.

If you are concerned about using a mobile banking application, it is important to recognize that security risks are present in various places, including within the bank premises.

Donald Korinchak from CyberExperts.com explains, “There is a possibility of an insider threat, where a bank employee engages in unlawful activities such as stealing your banking details”.

Regarding mobile apps, Korinchak notes, “There are potential weaknesses linked to the security features of the app itself - vulnerabilities in the code, encryption methods, and more - as well as vulnerabilities associated with data transmission”.

Korinchak further adds, “In both situations, banks dedicate significant resources to embed security measures. Financial institutions monitor their employees’ actions and proactively address vulnerabilities in their app to prevent exploitation by malicious actors”.

By following strong mobile application security measures like multi-factor authentication, strong passwords, and knowledge of advanced cyber threats to banking applications, banks can effectively lower the chances of security breaches. This multi-layered strategy helps to protect sensitive data stored within the app, prevent unauthorized modifications, and enable banks to innovate in the digital age.

Get in touch with a security expert from ioSENTRIX to determine the appropriate level of security for your mobile banking application.