In the insurance industry, risk assessment helps insurance companies evaluate the risks associated with individual policies. This evaluation process, also known as underwriting, helps insurance companies determine appropriate premium amounts for policyholders by assessing various risks such as fluctuating morbidity and mortality rates, natural disasters, and more.

Insurance risk assessment involves different methodologies like stress testing, parametric, simulation, stochastic models, benchmarking, and deterministic approaches to create risk profiles for policyholders.These risk profiles influence the premiums on insurance policies.

To manage risks effectively, insurance companies collect extensive data on potential policyholders and insured objects and utilize data mining-based statistical tools and frameworks to gauge risk levels accurately.

Modern insurers increasingly rely on AI-enabled analytics and machine learning models to uncover hidden risk patterns, reduce underwriting time, and improve pricing accuracy across life, health, property, and auto insurance lines.

Dividing risks into categories helps managers combine data and work on risk-response strategies. The structured brainstorming method ensures that all risks are covered thoroughly within each category. Additionally, various tools can help visualize and evaluate potential risk events.

Examples are:

Categorization also enhances compliance reporting by aligning risks with frameworks like NAIC guidelines, Solvency II, and IFRS 17.

The NAIC created a cybersecurity law for the insurance sector. A study by NAIC identified key risks including underwriting, credit, market, operational, and liquidity risks. It also highlighted the importance of protecting nonpublic data through risk management.

Insurance companies now follow stricter data governance standards such as GDPR, CCPA, and NAIC’s Insurance Data Security Model Law to avoid non-compliance penalties.

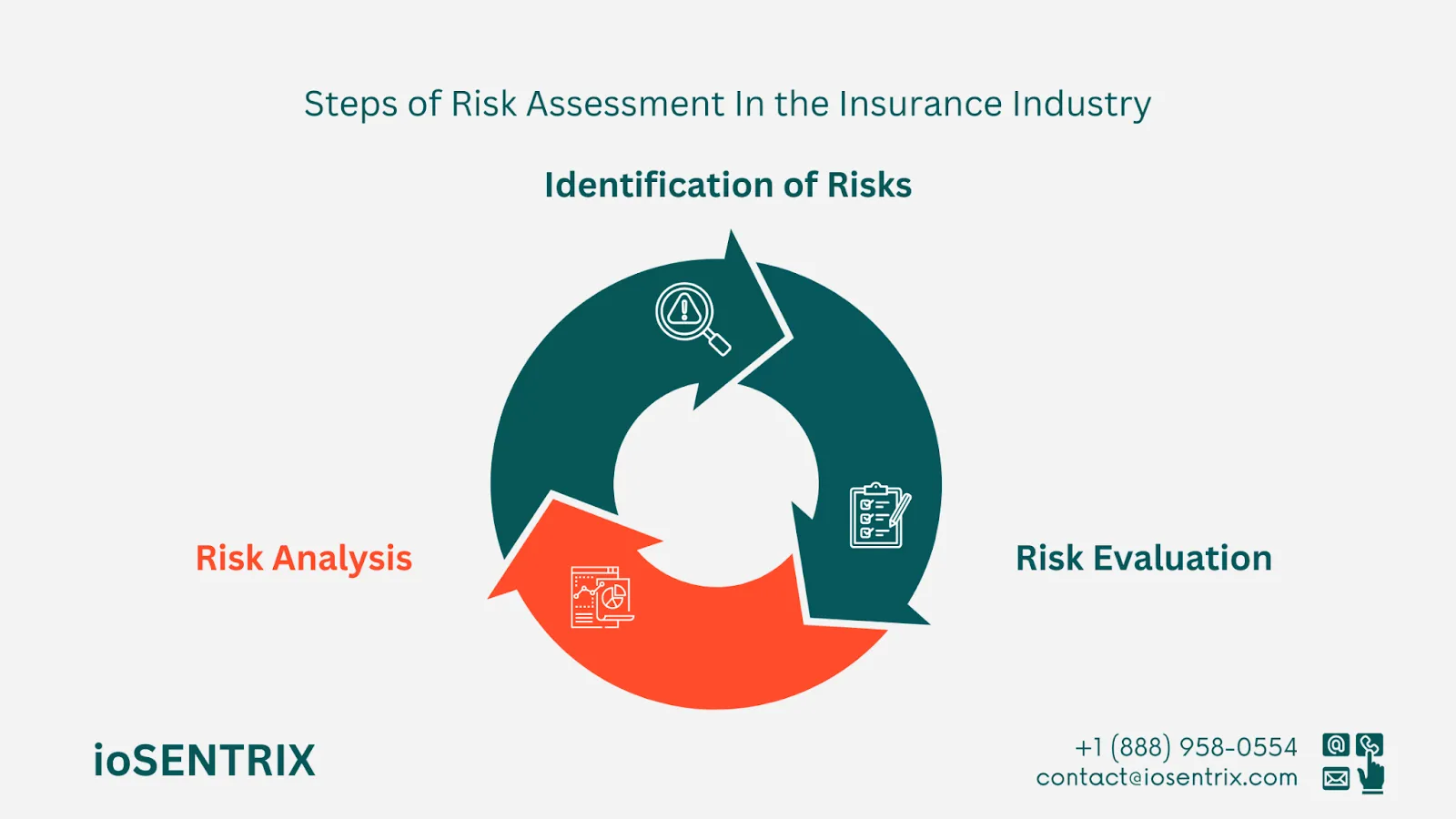

In risk assessment, the initial stage is to recognize possible risks. These may include natural disasters, like floods and earthquakes, or human actions, such as theft and accidents. Additionally, market risks linked to economic shifts impacting asset values, and operational risks tied to business activities, like machinery failures or supply chain interruptions, are important factors to consider.

Insurers also monitor behavioral risks using telematics, IoT sensors, and real-time data feeds to predict risky events before they occur.

After identifying risks, insurers analyze their likelihood and potential impact.

Blended approaches (quant+qual) are now common, especially in catastrophe modeling and health risk forecasting.

In the next phase, risks are carefully examined to determine which ones are most important based on how serious and often they occur. A comparison of the costs of managing risks to the advantages of lowering them is carried out, known as a cost-benefit analysis. This analysis assists insurance companies in determining which risks to insure, and how to price their policies effectively.

Advanced simulation models help insurers test thousands of “what-if” scenarios to find optimal pricing strategies and avoid over- or under-estimating premiums.

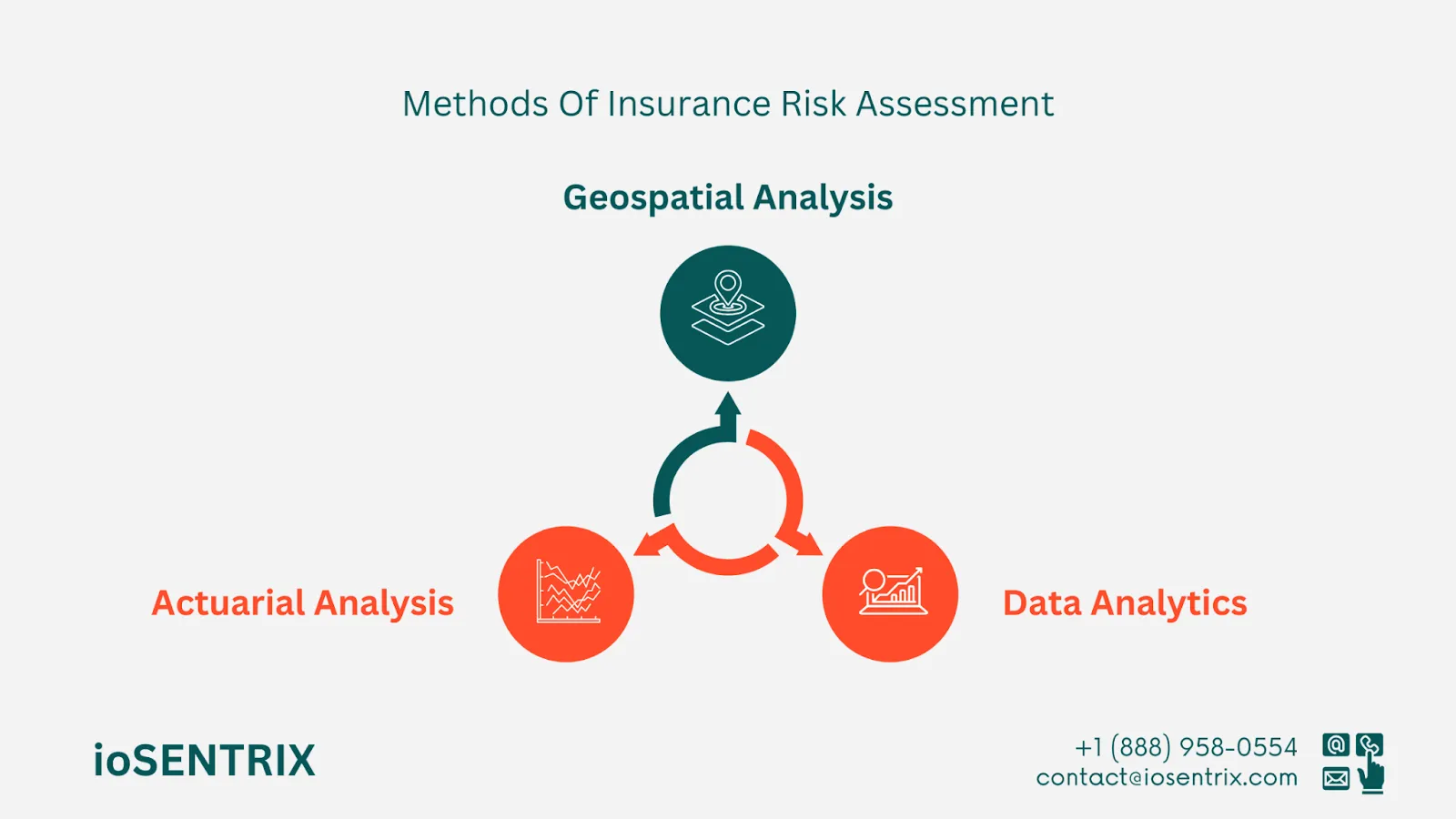

One method, actuarial analysis, relies on past data and statistical models to foresee future risk trends. Actuaries utilize life tables, loss distributions, and probability theories to determine life insurance premiums and other risk costs.

Data analytics and big data play a growing role in risk evaluation, with predictive modeling using machine learning algorithms to predict risks. For instance, predictive analytics can measure the likelihood of car accidents by analyzing driver behavior data obtained through telematics.

Geospatial analysis evaluates geographic risk-flood zones, wildfire-prone areas, earthquake belts.

FEMA flood maps are widely used by property insurers.

"GIS (Geographic Information Systems) combined with remote sensing allow insurers to assess risk at a micro-location level, improving underwriting accuracy and fraud detection"

Different sources give important information and numbers to evaluate risks. The Insurance Information Institute (III) shares data on insurance risks and industry trends, mentioning that U.S. insurers paid US$67 billion for insured losses from natural disasters in 2020.

FEMA offers tools for evaluating flood risks, showing that high-risk flood zones have a 26% chance of flooding during a 30-year mortgage. The NAIC releases reports on market behavior and risk assessment practices, indicating that U.S. life and health insurers had assets totaling US$8.3 trillion in 2020.

The Swiss Re Institute and Munich Re provide detailed information on natural disasters and risks worldwide. In 2020, Swiss Re reported that natural catastrophes caused insured losses of US$83 billion globally. Munich Re also stated that total economic losses from natural disasters worldwide were US$210 billion, with US$82 billion covered by insurance.

One common example of risk assessment in practice is seen in auto insurance. Insurers assess a driver's risk by considering their driving record, age, type of vehicle, and where they live. There are also programs like usage-based insurance (UBI) that provide discounts to safe drivers using telematics data.

In health insurance, risk assessment involves reviewing an individual's health, medical history, lifestyle, and demographics to determine premiums. For property insurance, risk assessment looks at the potential for damage or loss from natural disasters, fire, or theft, which may lead to higher premiums or extra measures for homes in high-risk areas.

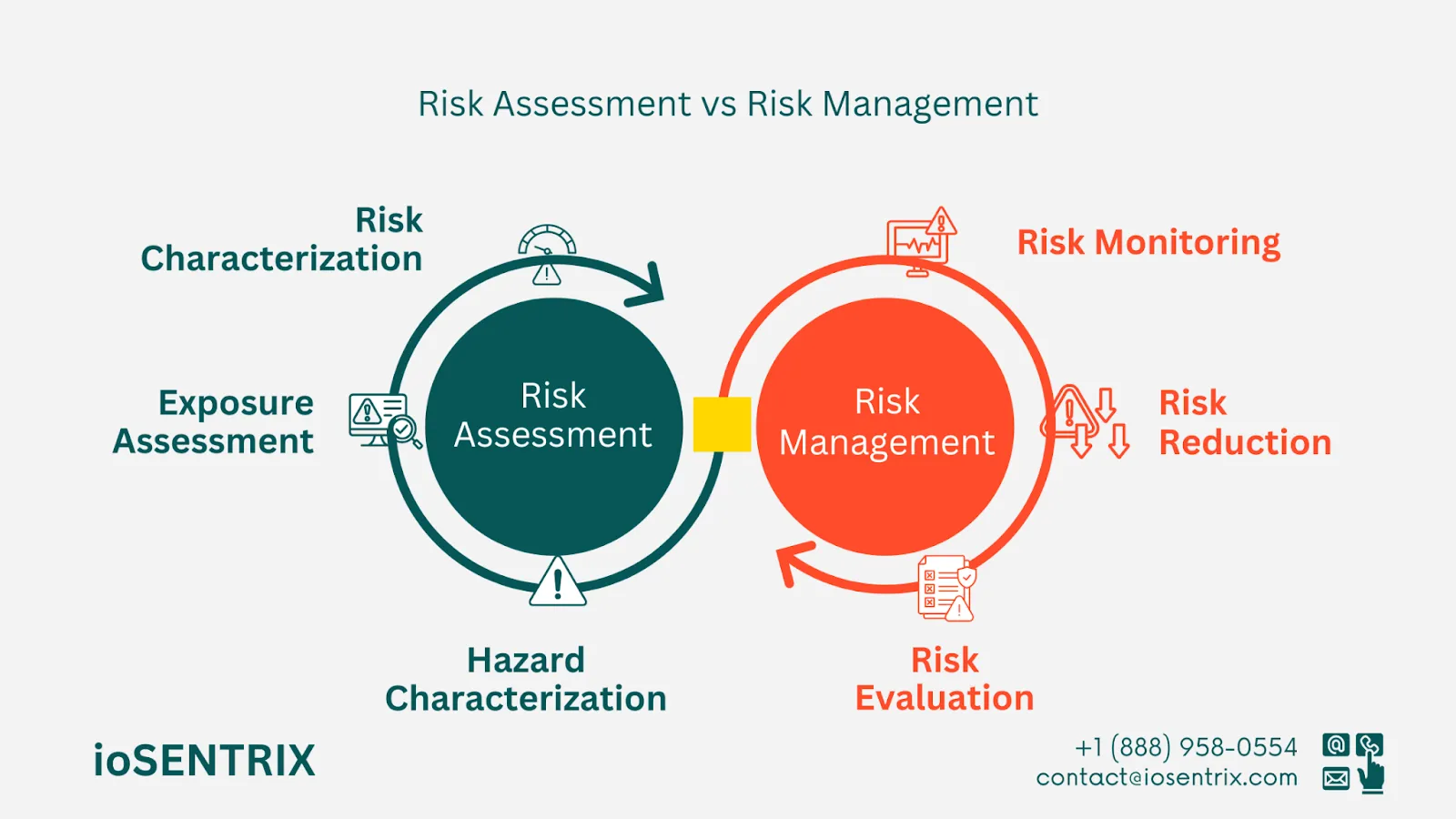

Vaidotas Sedys, the Head of Risk at Oxylabs, explains that, “Risk management is a broad concept that involves the organization's strategy and selected frameworks for managing risks. It includes tasks like identifying risks, creating plans to address them, and consulting with internal stakeholders, like top management, to decide if the risk is acceptable and how much should be invested in reducing it.

Risk assessment involves risk identification and analysis, both qualitatively and quantitatively, to determine the probability of specific risks occurring and the potential harm they could cause. Following the initial assessment, risks can be prioritized and continuously monitored.

It is essential to understand that conducting risk assessment, and sometimes risk monitoring as well, relies on having access to reliable and accurate data. The insurance sector, like several other industries such as finance, e-commerce, and cybersecurity, is adopting alternative data sources to detect and evaluate risks more effectively.

These sources could vary from satellite technology and IoT data to open web intelligence. For instance, alternative data is commonly employed to analyze credit risks in great detail.”

In the insurance industry, Internet of Things (IoT) data can provide immediate updates on accidents like fires or floods, helping speed up the processing of insurance claims. Online data, like tax records, can assess property values. Non-traditional data sources are effective in predicting short-term outcomes, giving companies a competitive advantage.

Risk assessment is the process insurance companies use to identify, analyze, and evaluate potential risks associated with policyholders or insured assets. It helps determine premium pricing and underwriting decisions using statistical models, data analytics, and risk evaluation frameworks.

Accurate risk assessment helps insurers avoid financial losses, prevent fraudulent claims, ensure regulatory compliance, and set fair premium rates. It also improves customer segmentation, pricing accuracy, and long-term profitability.

Insurers use actuarial modeling, data analytics, geospatial analysis, simulation models, stress testing, and stochastic modeling. Modern companies also use AI-driven predictive analytics and ioSENTRIX risk management solutions to enhance accuracy.

Insurance companies assess multiple risk categories, including financial risks, operational risks, compliance risks, strategic risks, cybersecurity threats, and natural disaster exposure. These categories help insurers build accurate risk profiles for policyholders.

Iosentrix provides the optimal solution for these challenges, offering advanced risk management tools that integrate data analytics, IoT insights, and predictive modeling. With Iosentrix, insurance companies can enhance their risk evaluation processes, ensure data security, and maintain a competitive edge in the industry.

To learn more, connect with our experts here.