Mergers and acquisitions (M&A) are an important strategy for business growth. They help companies expand their market presence, offer new products, and improve their competitiveness. However, the success of M&A deals often depends on how well the merged companies are integrated after the merger, known as Post-Merger Integration (PMI).

This guide aims to give M&A project leaders the information they need to manage PMI effectively and create value from their deals.

“Post-Merger Integration (PMI) is the process of combining the operations, cultures, systems, and structures of two merging companies to form a unified and functional entity. The goal is to achieve synergies, operational efficiency, and a cohesive culture.”

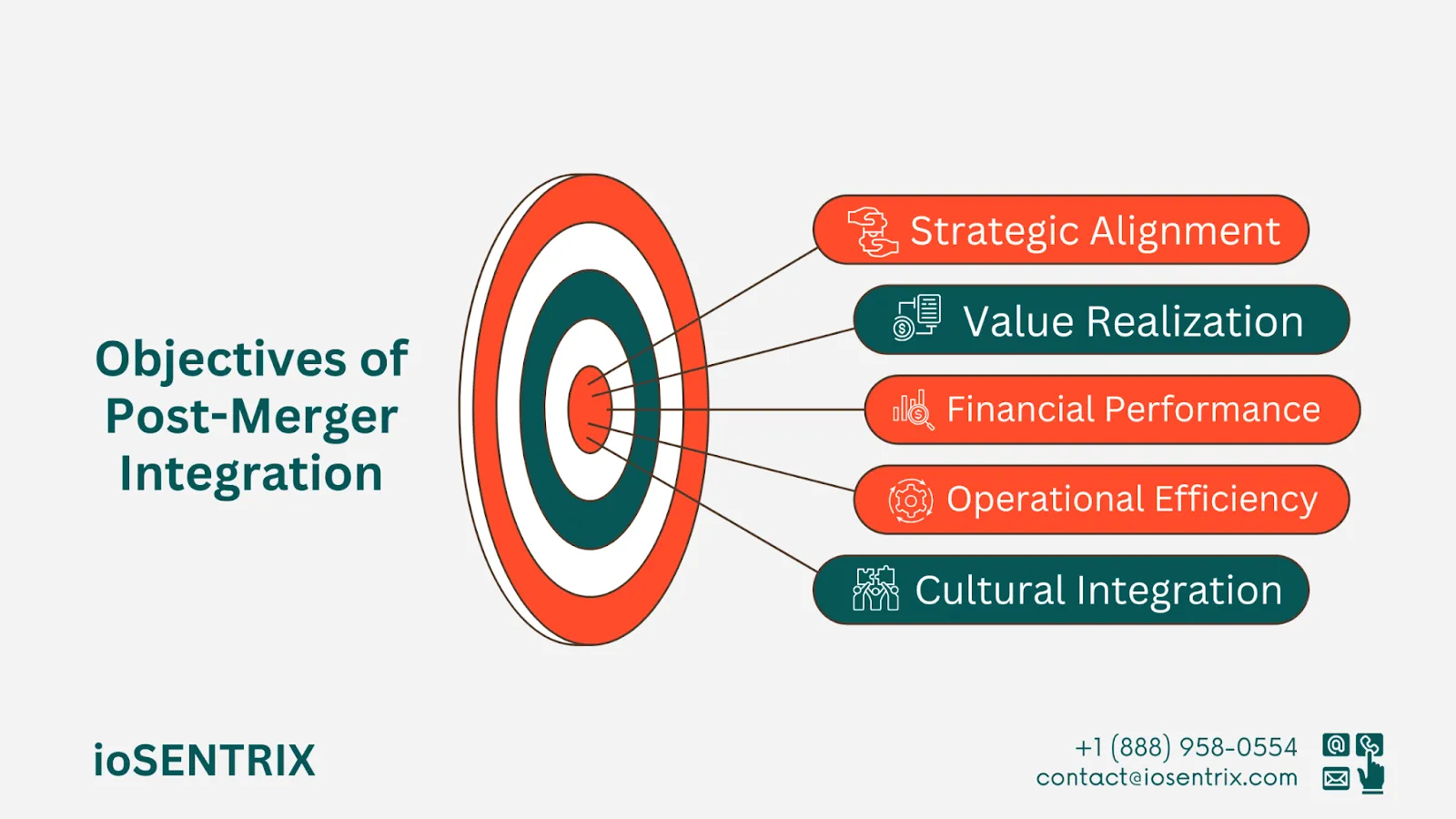

A post-merger integration strategy includes strategic alignment, operational consolidation, and human resource integration.

Studies from Harvard Business Review show that a high percentage of mergers and acquisitions don’t meet expectations. Around 70-90% of deals fail to deliver the anticipated value, with over 60% leading to a decreased shareholder value. This failure is often due to ineffective integration strategies.

A carefully planned and well-executed post-merger integration strategy can help bring about synergies, cut costs, improve efficiencies, and build a more competitive business. On the other hand, inadequate integration may result in disruptions, talent loss, cultural conflicts, and failure to meet strategic goals.

For example, In 2012,Facebook purchased Instagram for around $1 billion. This merger united two well-known social media platforms and strengthened Facebook’s mobile reach and advertising potential.

An important date in history, January 24, 2006, signaled a significant turning point in the world of animation. Disney’s announcement of its intention to purchase Pixar for $7.4 billion in stocks captured global attention and stands as one of the largest corporate mergers ever.

When companies merge, they might have different goals and strategies compared to when they were. Post-merger integration (PMI) is a process that makes sure these differences are reconciled to match the long-term vision of the newly combined entity.

In general, mergers and acquisitions (M&A) are done to combine strengths and make profits. Post-merger integration (PMI) helps ensure that the expected advantages, like gaining more customers, saving money, or getting new technology, are achieved.

Combining two different operations into one location is typically done to simplify processes, reduce redundancy, and establish one effective operating system.

When two companies merge in an M&A, they must address the challenge of combining their separate company cultures. A crucial goal of Post-Merger Integration (PMI) is to create unity and collaboration among employees from both companies by harmoniously integrating their cultures.

Ensures business stays on track to meet financial goals and adds value for shareholders through a successful merger. This can be accomplished by establishing specific integration objectives, identifying key performance indicators, and staying committed to realizing value.

When strategies are harmonized, companies can utilize the unique capabilities of each component for competitive positioning and sustainable expansion.

An effective post-merger integration relies on teamwork from different groups within the company. Let’s look at the common teams and what they do:

Executive Leadership: Responsible for strategic guidance, alignment with company objectives, and supervising the integration process.

PMI Team: The skilled team, under the guidance of a seasoned Integration Manager, is in charge of the complete PMI process. Their responsibilities include planning, forming a post-merger integration checklist, resource management, and overseeing the smooth implementation of all integration tasks.

Functional Integration Teams: Teams from essential business departments such as finance, human resources, marketing, and information technology have the task of merging their specific areas.

Change Management Team: This team oversees employee communication, deals with concerns, and promotes cultural acceptance.

Leaders must have a clear vision, make prompt decisions, and maintain open communication to ensure the integration stays on course. The Integration Manager should be adept at facilitation, negotiation, and solving problems, capable of handling difficult situations and guiding teams from various departments.

A dedicated team for post-merger integration allows for concentrated efforts on integration tasks.

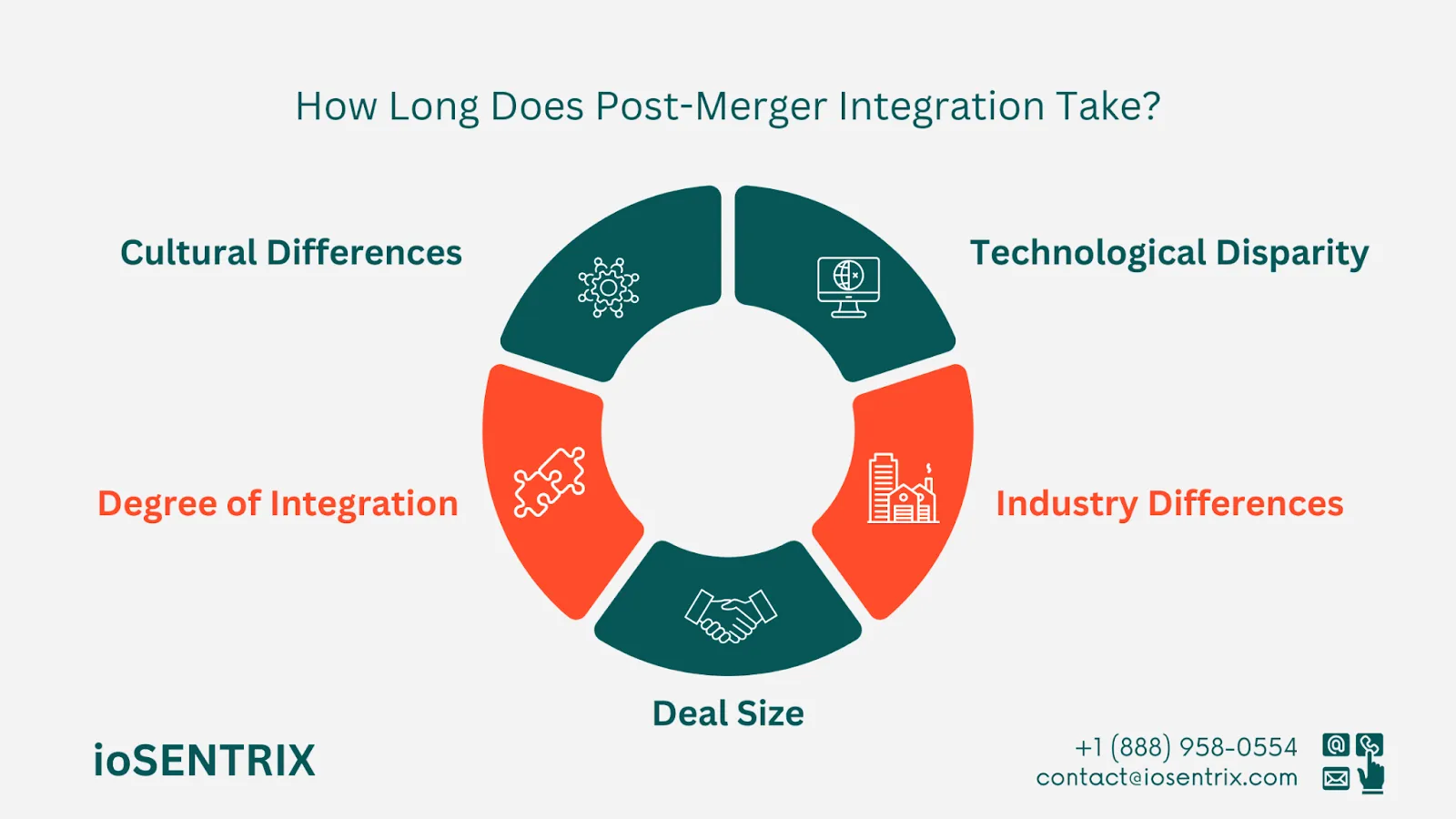

The time it takes to complete a PMI process can differ based on how complicated and large the merger or acquisition is. For smaller mergers, integration could be finished in a year, but for bigger and more intricate ones, it might extend to several years. Various factors can affect how long the process lasts, such as:

Deal Size: Bigger transactions require more components to be coordinated and take longer to incorporate into the existing system.

Industry Differences: Merging businesses from diverse industries may pose challenges because of different rules, procedures, and responsibilities regarding regulations and compliance.

Cultural Differences: Integrating companies with diverse cultures could take more time to address resistance, match values, and encourage teamwork.

Degree of Integration: The level of integration desired, whether full absorption, partial integration, and so on, can also affect the timeline.

Technological Disparity: Combining IT systems and infrastructure may take a considerable amount of time, especially when there are notable disparities in technology platforms.

An effective post-merger integration plan sets clear goals and deadlines to ensure the integration progresses smoothly and stays on schedule.

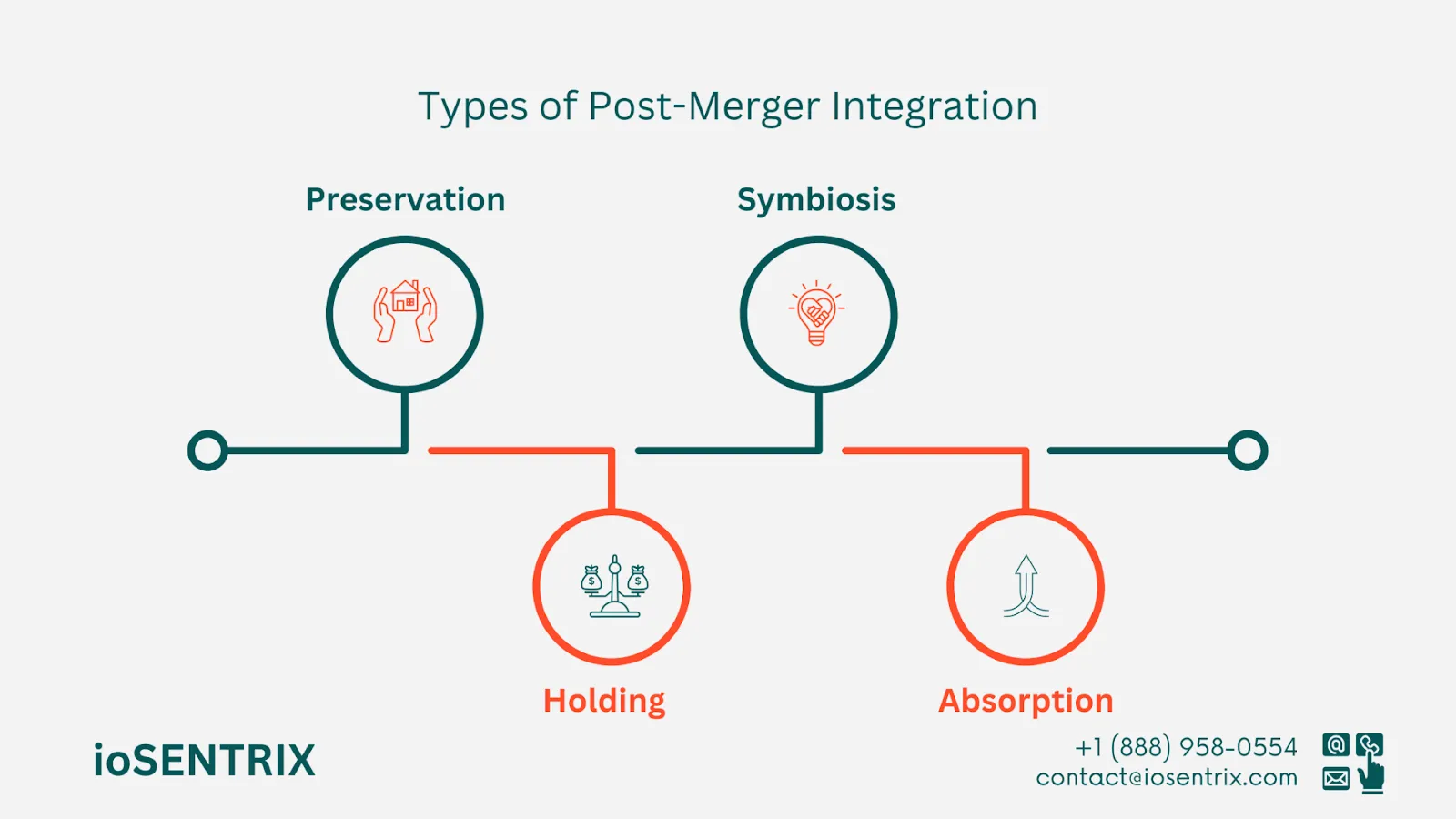

This approach keeps things running smoothly without major changes, while also preserving the separate operations and cultures of the merging companies. It’s best for mergers that bring different strengths to get the most out of their combined expertise. Preservation is often chosen when the acquired company has special skills or a unique brand that the acquiring company wants to keep intact.

In the holding approach, the acquiring company assumes control of the acquired company while allowing it to operate independently. This strategy is commonly employed when the acquired company is a subsidiary or strategic business unit of the larger organization. The acquiring company aims to maintain the acquired company's way of conducting business and culture while also leveraging its financial success.

Symbiosis is a balanced integration strategy where two companies collaborate to integrate specific functions while still maintaining some independence. This model encourages a cooperative atmosphere where companies exchange best practices and resources to get mutual rewards while reducing disruptions. It is particularly advantageous for mergers focused on knowledge transfer and innovation.

In this type of integration, the acquired company becomes fully part of the acquiring company. They combine operations, cultures, and technologies to form one entity. This method is commonly used when there are many benefits from joining completely, like saving money, working more efficiently, and having a stronger market position. The integration model chosen depends on the merger’s goals, the companies’ sizes and complexity, and how well their cultures align.

Different challenges can hinder the success of post-merger integration (PMI). These challenges are diverse and should not be underestimated. The technical and business complexities involved in PMI can pose a significant barrier to achieving the project’s anticipated advantages.

McKinsey & Company has attributed certain M&A disappointments to the absence of value creation. The reasons for such failures can range from disagreements over pricing and inadequate strategic planning to political challenges, among others.

Based on Deloitte’s findings, 6% of major M&As encounter challenges during the post-merger integration phase. When the integration process falls short of achieving the merger’s goals, its potential value remains untapped. Therefore, M&A leaders should utilize technology like enterprise architecture for the synergies necessary for a smooth post-merger integration.

According to a study by PWC, technology plays a crucial role in deal-making success. The research reveals that 54% of successful deal makers fully incorporate their IT function, while only 27% of unsuccessful deal makers do the same. Interestingly, after two years, 77% of unsuccessful deal makers have not completed IT integration, in contrast to all successful deal makers who have successfully integrated IT.

Achieving success in mergers and acquisitions largely depends on the careful planning and implementation of the post-merger integration (PMI) process. A key challenge in PMI is integrating two separate IT systems, which can be complicated.

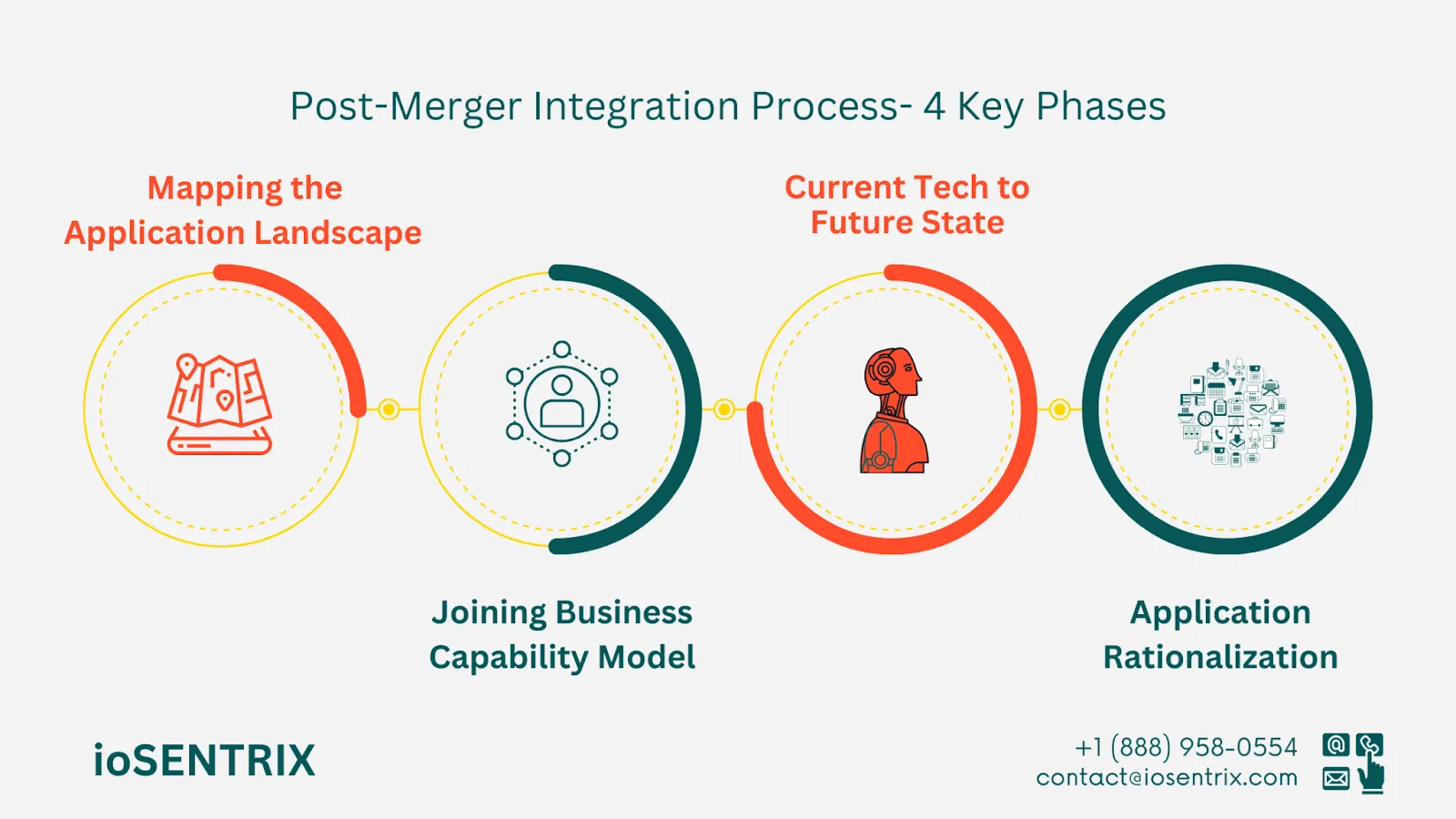

To ensure a successful integration, business leaders can follow four key phases to negotiate the technical aspects of PMI effectively.

In the initial stage, the focus is on reviewing the software resources of both companies. This involves carefully listing all the applications they currently use.

Core Business Applications: These essential systems are vital for running key business operations such as finance, human resources, and customer relationship management.

Departmental Applications: These tools are designed for specific departments, such as marketing automation software or project management platforms.

Legacy Systems: These are older applications that may still be in use, however, they are not viewed as essential for future operations.

Enterprise Architecture tools can generate visual representations of the application portfolio, showing usage, users, billing, and management details. This comprehensive view improves accuracy and efficiency in mapping and giving stakeholders better insight.

Once the software environment is understood, company executives can utilize Enterprise Architecture to create a unified business capability plan. This plan describes the envisioned future operations of the merged organization, creates a shared vocabulary for teams following the company’s strategy, and identifies any duplications or deficiencies.

By combining the information from the application portfolio overview, the business capability model can assist in determining which applications from each company will most effectively support the new unified organization's target capabilities. This serves as a basis for the future state of the integrated organization.

After determining the desired future state, the next step is to connect the current IT setup with the planned future system. This involves evaluating how well existing applications meet the upcoming technical and functional requirements.

Enterprise Architecture is essential for this process as it creates future-state models and plans the transition from the current state to the future. It ensures data accuracy and supports effective cost-benefit analyses for achieving future goals.

During the mapping phase, existing applications are matched to the functions required in the future. This assessment identifies applications that have low value, duplicate the functions of other tools, have unnecessary redundancies, and may pose challenges during post-merger integration. This process assists PMI leaders in planning smoother transitions toward achieving the desired outcome or final integration state.

The last stage simplifies the combined application setup. The results of the earlier evaluation serve as the groundwork for organizing and making suggestions for all the applications.

Those in charge of projects can turn to Enterprise Architecture for guidance on how to improve various aspects such as IT expenses, IT risk exposure, and the alignment of IT with business objectives. Pre-built dashboards on a tool can identify where value is being generated and where improvements can be made.

Application rationalization typically involves:

Effective Change Management Is The Key To manage the different stages of a merger efficiently, it is essential to have a detailed plan for post-merger integration change management. This involves explaining the reasons for any IT changes, offering training on new systems, and encouraging teamwork among different departments.

Successful post-merger integration is vital for the success of mergers and acquisitions. With a clear process, architecture tools, and good communication, organizations can overcome challenges and maximize the benefits of a merger.

Strong leadership, a committed team, careful planning, and emphasis on aligning strategies and realizing value are essential for effective post-merger integration. With the right plan, knowledge, and tools, businesses can turn M&A transactions into fruitful ventures that create value.