Online payment processing is crucial for modern businesses. As internet transactions increase, securing payment systems becomes vital. This article highlights the importance of secure payment processing and offers tips to safeguard online transactions.

A secure payment system (SPS) is a payment setup that shields your business from unauthorized access by fraudsters, especially in online transactions. This protection is achieved through various important elements like encryption, tokenization, multi-factor authentication, and fraud detection systems.

Secure payments systems play a vital role in the worldwide payment network, and safeguard your business and customers from fraudulent activities like fund theft and data breaches.

The reliability of secure payments systems is ensured by following specific industry standards and rules such as Payment Card Industry Data Security Standard (PCI DSS) and EMV.

Encryption changes sensitive information into unreadable codes to keep it safe when being sent or stored. When a customer pays, the data gets encrypted before going through the payment network and then decrypted at the recipient’s end.

For Instance, Credit card numbers can be encrypted by mixing them up and turning them into ciphertext. Only someone with the decryption key can change the data back into a readable form.

Encryption is categorized into two types: symmetric and asymmetric

Symmetric Encryption: Data is both encrypted and decrypted using the same key, which boosts efficiency but compromises security to some extent.

Asymmetric Encryption: Distinct keys for encryption and decryption—a public key for encryption and a private key for decryption. While asymmetric encryption may be slower, it significantly enhances security measures.

When a customer enters payment details online, the information is encrypted before it is sent. This means that even if someone intercepts the data, they won’t be able to read it without the decryption key. Payment information that is saved, such as credit card details on online shopping websites, can also be encrypted to increase security.

A payment gateway assists in online transactions by facilitating the exchange of information between a business’s website or application and a bank or payment processor. It verifies the customer’s card details, confirms the availability of funds, and swiftly enables payment transfers, typically processing them within a matter of seconds.

When a customer decides to pay for a product or service online, the payment gateway manages the transaction, similar to a digital version of a physical point-of-sale (POS) terminal. The payment gateway guarantees that the funds are securely and promptly transferred from the customer’s account to the business account.

Tokenization, similar to encryption, changes sensitive data into an unreadable form. The key contrast is that instead of mixing up the original data, it swaps it completely with a token—a distinct sequence lacking inherent meaning on its own. Consequently, when transmitted across the payments network, even if intercepted, a fraudster cannot decipher the token. The initial data is safely kept in a data vault.

When a customer enters payment information for online shopping, tokenization systems substitute this data with tokens. This implies that during future transaction procedures, sensitive information is not transmitted or kept in various places—instead, the token moves around, thus, providing a safe transaction.

Multi-factor authentication is a security procedure that demands users to offer various types of identification before the system allows access or authorizes transactions. By making sure users confirm their identity through multiple validation methods, multi-factor authentication adds an extra layer of protection.

In situations involving payments or accessing accounts, multi-factor authentication (MFA) can ask users to first enter a password and then input a one-time code sent to their mobile phone. Confirmation from two or more places significantly raises the difficulty level for unauthorized access, particularly in transaction situations.

For example, MFA can utilize:

Knowledge factor: Information the user knows, like a password or PIN.

Possession factor: Items the user has, such as a smart card, security token, or a text message sent to their phone.

Inherence factor: Characteristics inherent to the user, like a fingerprint, facial recognition, or voice pattern.

Systems that prevent fraud (or detect it) use both machine learning and rules created by humans to identify strange actions or doubtful activities and stop the transaction.

To achieve this, they examine all payment data entering your system in real-time and compare it to past data collections to identify irregularities. Meanwhile, machine learning operates in the background to grasp emerging trends and fraud schemes.

An irregularity might range from a purchase by a user in a country with a reputation for high fraud levels to numerous small transactions carried out using the same payment card.

In online or offline transactions, the Fraud Detection System (FDS) constantly watches and examines the data movement. If a transaction seems questionable, like a purchase made in another country right after one in the user’s home country, the system might highlight it. This could result in extra verification procedures or pausing the transaction temporarily for more investigation.

Read more on: How to Detect Best Fraud Detection Software?

EMV is a payment technology that enhances the security of card transactions by using a small but strong chip in credit and debit cards. This technology was created in the mid-1990s and has now become the norm for safe card payments. EMV technology is managed by a group called EMVCo, which counts major credit card companies like Mastercard, Visa, American Express, Discover, JCB, and UnionPay among its members.

PCI DSS stands for “Payment Card Industry Data Security Standards.” These standards are a set of rules meant to guarantee that any business handling credit card information keeps a safe environment. Major credit card companies developed PCI DSS to safeguard cardholder data against theft and to enhance the security of payment card systems.

Businesses following PCI DSS guidelines ensure that cardholder data is safeguarded at every step during a transaction. Starting from when a customer swipes their card or inputs their card details online, to the storage and processing of this data, the standards cover encryption, safe storage, and limited access.

For your business to stay, it must fulfill its commitments to customers, financial regulators, and stakeholders. This involves addressing various risks through diligent payment management. Numerous tasks linked to handling online payments responsibly can be automated based on the business owner’s particular requirements and preferences using payment orchestration.

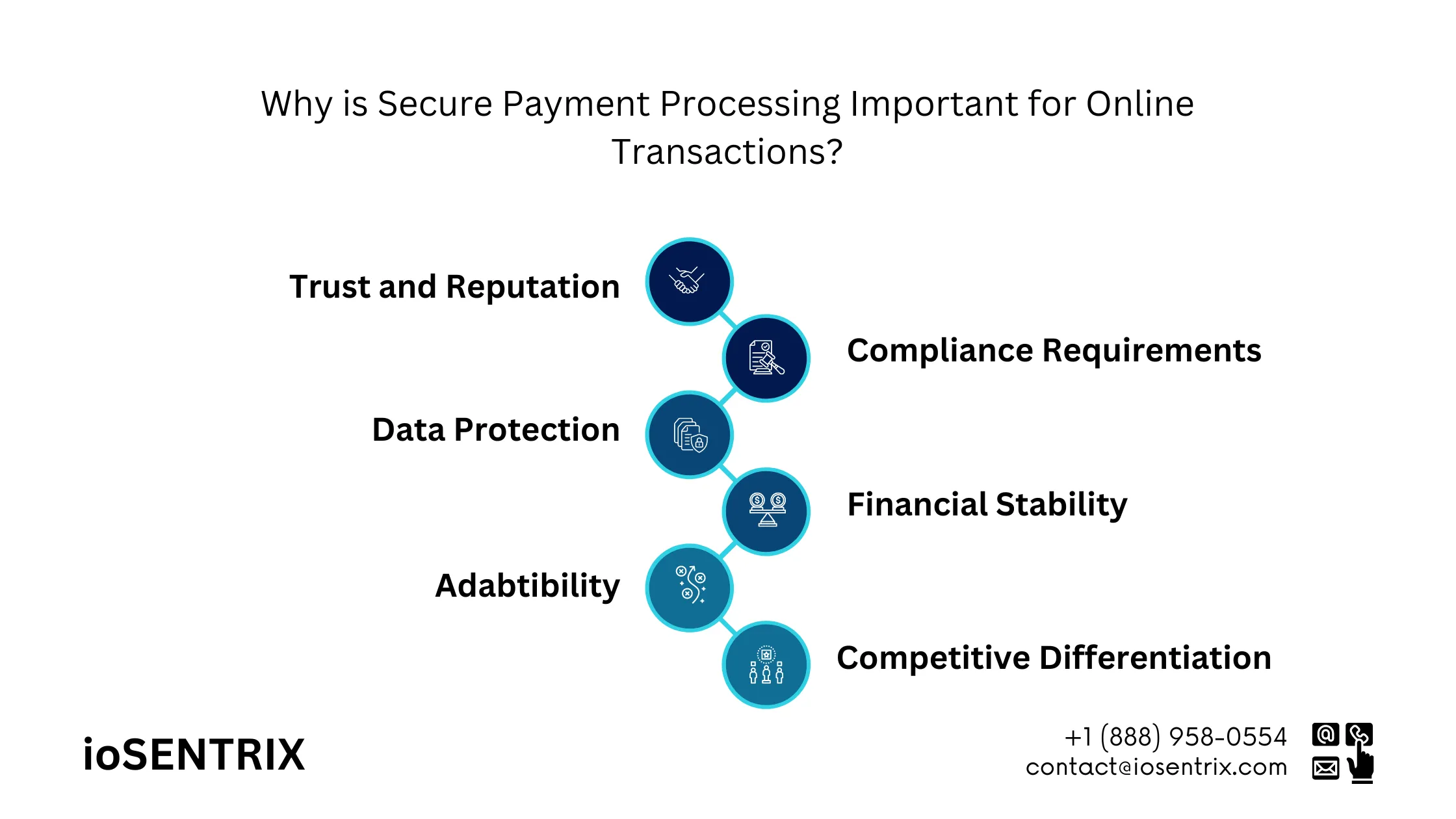

The following are the primary reasons why secure payment processing is important:

Online transactions are at high risk of data breaches, where hackers try to access and steal customer information from weak systems. Safeguarding this sensitive data is crucial, as fraudsters could exploit it to commit crimes against both businesses and individuals.

In the payment industry, standards like PCI DSS demand strict security measures to protect customer card data from fraud in online transactions. Additionally, if you do business in the EU, you must follow PSD2 Strong Customer Authentication (SCA) rules, which boost online payment security through multi-factor authentication. Not meeting these standards could lead to significant fines and legal consequences.

A company’s reputation is extremely important. Each safe transaction builds this trust, but any breach, even a small one, can damage years of positive relationships. Customers need to feel confident that their private information is handled carefully. A High-level payment security sends a strong signal to customers that a company respects their trust and is dedicated to safeguarding their concerns.

Apart from the clear danger of losing money due to deceitful actions, there’s also the potential for fines and punishments for not following industry rules. Secure payment systems assist businesses in steering clear of these expenses. For instance, in 2023, the worldwide average cost of a data breach was almost $4.5 million, a 15% rise over three years—an alarming sum that can shake many companies.

In crowded markets, companies are constantly looking for ways to stand out from competitors. Introduction of high-level payment security can act as a way to set themselves apart. Customers are more inclined to interact with a company when they see it as secure, especially in industries where financial transactions are a key part of the user experience.

The business world is always changing, with new technologies, payment methods, and customer preferences appearing frequently. A reliable secure payment system guarantees that a business is safeguarded not only now but also ready to embrace and incorporate future innovations smoothly.

Creating and keeping up a secure payment system is crucial for any business. It’s a commitment not only to technology but also to trust, operational consistency, and future flexibility.

To stay compliant, you can utilize integration options like to secure your card transactions without managing the card data on your systems. While you can maintain PCI compliance with our Full Card API, you will require additional measures to protect the data and complete more detailed forms during your annual PCI DSS evaluation.

In secure online payments, TLS data encryption plays a vital role. When a purchase is made online, sensitive details like credit card numbers, expiration dates, and CVV codes are sent over the internet. Without proper encryption, this data could be captured by malicious individuals and misused for fraudulent purposes.

TLS encryption safeguards the interaction between the customer’s browser and your company’s website server, and ensures that sensitive details are transmitted securely and cannot be intercepted or viewed by unauthorized parties.

TLS also verifies the server’s identity, helping to prevent man-in-the-middle (MITM) attacks. This verification is crucial to confirm that customers are interacting with your legitimate business and not with a malicious entity.

A notable advantage of 3DS2 is its user experience for future transactions at the same merchant. Users can verify themselves with the card issuer for subsequent purchases, not needing to repeat the authentication process each time they return to checkout.

Additionally, 3DS2 offers more detailed transaction data, enabling businesses to make well-informed choices on whether to approve or reject a transaction. This feature helps minimize false declines, which can be both costly and frustrating for businesses and customers.

In online transactions, the Card Verification Value (CVV) acts as a security measure that helps merchants verify the cardholder’s identity when they are not physically present for the transaction. Typically, a CVV consists of a three-digit code located on the back of most Visa, Mastercard, and Discover cards, or a four-digit code on the front of American Express cards.

When a cardholder provides their card information during an online transaction, the merchant or payment processor will request the CVV. Following this, the merchant will receive a CVV response code to determine if the cardholder possesses the physical card.

Since the CVV is neither embossed nor stored on the card’s magnetic stripe or chip, it is less susceptible to being compromised in a data breach.

Fraud detection tools are systems or software created to spot and stop fraudulent activities. Businesses employ these tools to catch and prevent fraudulent transactions, shield against financial losses, and adhere to industry rules.

Different types of fraud detection tools include:

Rule-based systems: These systems utilize set rules and algorithms to pinpoint and mark fraudulent transactions.

Behavioral analysis: They inspect user and transaction behaviors to spot patterns that could hint at fraud.

Machine learning: Using AI, these tools employ advanced algorithms and models to learn from past data and spot potential fraud patterns.

Biometric authentication: These tools use biometric data like facial recognition, fingerprints, or voice recognition to verify users.

To train your employees effectively for secure online payments, consider the following steps:

Regular Training: Conduct frequent training sessions to educate employees on online payment security best practices, emphasizing fraud detection, prevention, and proper handling of customer data.

Implement Policies and Procedures: Establish clear policies and procedures for secure online payments. Ensure that all employees are familiar with and adhere to them.

Emphasize Security Importance: Stress the significance of online payment security to your employees, highlight the legal consequences of neglecting security protocols.

Encourage Reporting: Promote a culture of reporting by urging employees to notify management of any suspicious activities or security concerns. Utilize emails, posters, or other communication channels to reinforce this message.

Conduct Regular Security Audits: Periodically perform security audits to identify and address vulnerabilities in online payment processes. Ensure that these audits are conducted constructively to support security enhancement rather than punitive measures.

Inform of New Threats: Keep employees informed about emerging threats and vulnerabilities through regular updates via email or direct communication. Provide training to equip them with the skills to respond effectively.

Utilize Security Technologies: Employ security tools like encryption, firewalls, and antivirus software to safeguard online payment transactions and data.

A simple method to ensure secure online payments is by connecting with a top-tier merchant such as ioSENTRIX. With a track record of handling over hundreds of transactions annually, our all-in-one payment system includes comprehensive fraud detection features. This setup helps maintain your business’s compliance, secures payments, and ensures customer satisfaction.